Archive for March 2019

2018 Farm Bill Passes – Now What?

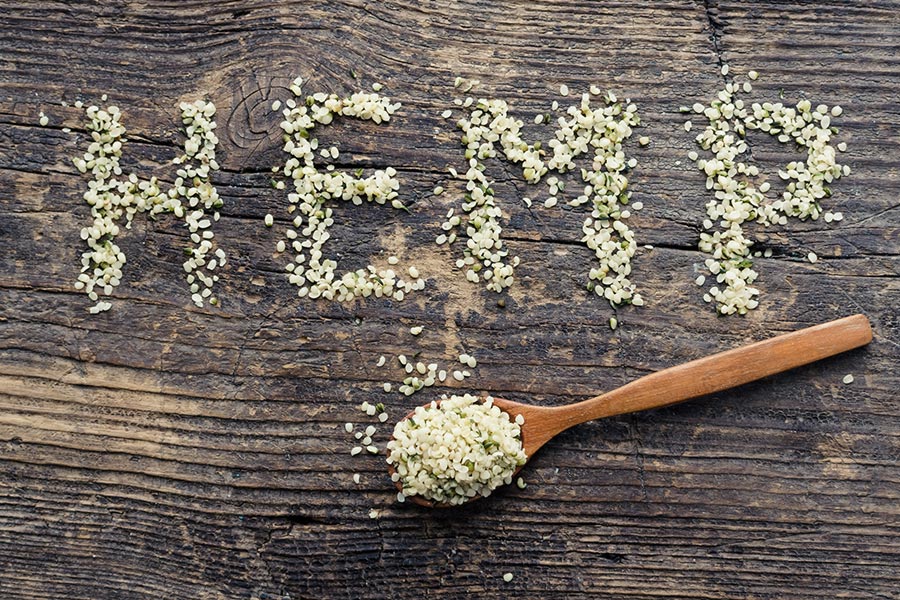

A hot topic of discussion this year has been the 2018 Farm Bill, more formally, the Agricultural Improvement Act of 2018, and what it means for the burgeoning hemp industry. Attorneys in the space get calls regularly on the issue, with clients asking some form of the question: “Is hemp now fully legal?” If you…

Read MoreCOUGAR DEN WINS AGAIN IN SCOTUS

On March 19, 2019 the Yakima Nation won an important motor fuel tax case against the state of Washington in the Supreme Court of the United States. The case centered on whether a fuel importer, who was owned by the Yakima tribe, could be forced to pay $3.6 million of taxes for importing motor fuel…

Read MoreFarm Bill Passes – More Uncertainty for the Hemp Industry, For Now

A hot topic of discussion this year has been the 2018 Farm Bill, more formally, the Agricultural Improvement Act of 2018, and what it means for the burgeoning hemp industry. Attorneys in the space get calls regularly on the issue, with clients asking some form of the question: “Is hemp now fully legal or not?”…

Read MoreLow Income Housing Tax Credits – Part 1

Low Income Housing Tax Credits (“LIHTC”) are a great tax planning tool that real estate developers and investors should take advantage of. Additionally, LIHTC can overlap with other tax credits and tax breaks to further maximize return on investment. LIHTC projects and other tax credits and tax breaks can be used in conjunction, with proper…

Read MoreFL DBPR Ordered to Pay Blunt Wrap Company’s Attorneys Fees

In 2016, Florida’s appellate court ruled that blunt wraps are not taxable in Florida. In Brandy’s, the court determined that a blunt wrap was not a taxable “tobacco product,” because it did not meet the statutory definition as ‘loose tobacco suitable for smoking.” Specifically, the court said that the blunt wraps was a “distinct cohesive…

Read MoreWhat is Use Tax Reporting?

While businesses scramble to abide by new economic nexus laws in the post-Wayfair craze, many are overlooking a potentially even larger burden. This burden, Use Tax Reporting, has been lurking since before the Wayfair case and has become only more relevant after it. Use Tax Reporting evolved when states were restricted by the then-current case…

Read MoreWhat is Affiliate Nexus?

Affiliate nexus is imposed when an out-of-state business has an “affiliate” located within the state. The theory behind affiliate nexus is that the relationship between the in-state business and out-of-state business is such that the out-of-state business has a sufficient presence within the state for it to be required to collect and remit sales tax.…

Read More